Where do you start? And when should you start?

Firstly, you need to focus on the lifestyle you want in retirement and then how you plan on getting there.

What if your plan changes?

That’s fine. You can make adjustments along the way. In fact, a retirement plan shouldn’t be a ‘set and forget’ strategy. Chances are your imagined needs in your 20s may look quite different by the time you reach your 50s.

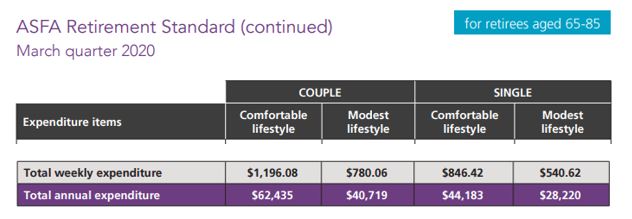

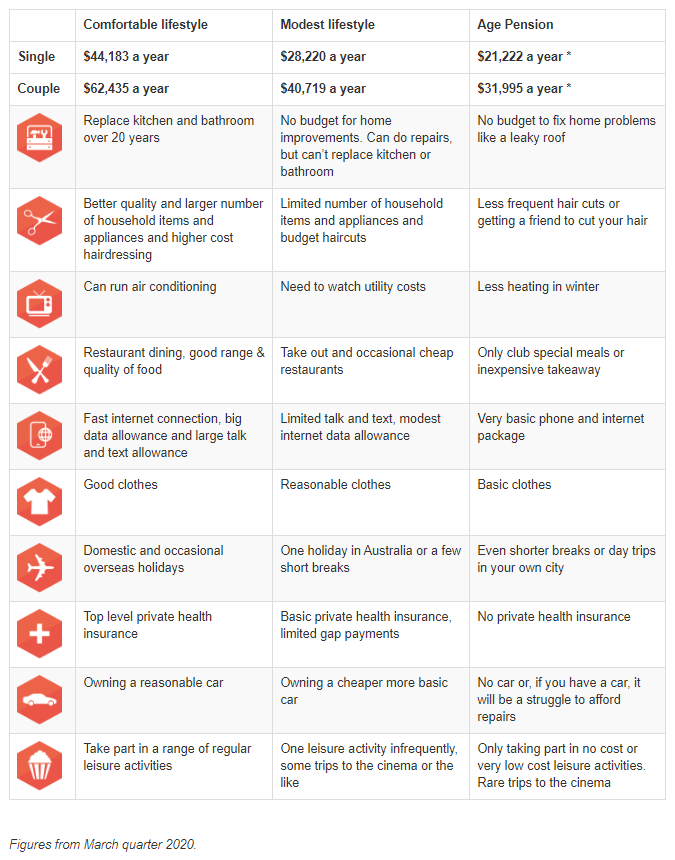

A good starting point is to calculate how much you need to provide for comfortable retirement years.

What is a comfortable lifestyle?

For most of us this means being able to pay bills without financial stress, the odd holiday, maintain a house and car and an occasional indulgence. You will generally require 60-80% of your pre-retirement income to lead the type of active life you probably desire IF you have paid off your mortgage.

It was previously assumed the first ten years of retirement would be your most active AND most costly. With longer life spans and an increase in the chance of health or mobility issues this could change.