Xero has released Step 1 to get ready for Single Touch Payroll Phase 2.

Step 1 involves updating your employee profiles with additional information required by the ATO.

We have included some screenshots guide your through this process. You will need to complete this for each of your active employees.

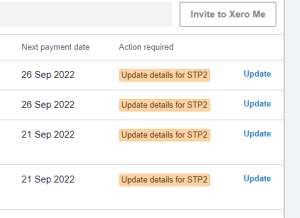

Go to Payroll – Employees

Click ‘Update’ and complete the below steps for each employee.

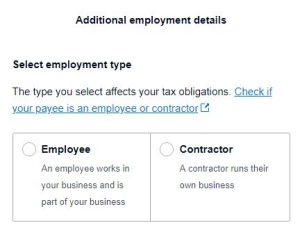

Select what type of employee you have as per below:

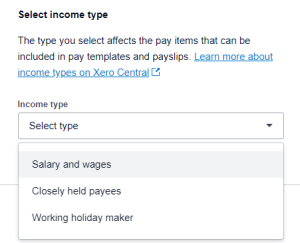

Select the employee’s income type.

Note: Closely held payees is defined as an individual directly related to the entity from which they receive payments.

For example: family members of a family business, director or shareholders of a company, or beneficiaries of a trust.

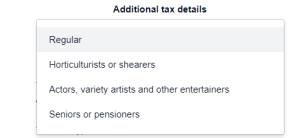

Select the employee’s tax scale type.

Once this has been completed for all employees, you have completed Step 1. Steps 2, 3 and 4 will be released in the coming months, with everything being update by March 2023.

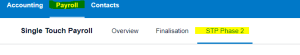

Xero have additional information regarding STP Phase 2, and this can be found in the below noted location within your Xero file.

For a printable version click the link STP Phase 2