What’s driving it and is there any light at the end of the tunnel?

Key points

- Share markets remain under pressure from high inflation, rising rates and bond yields and the rising risk of recession and the threat that poses to company profits.

- With the rising risk of global recession, global and Australian shares are at high risk of further falls in the short term.

- However, it’s not all negative. Pipeline inflation pressures are continuing to decline, and inflation expectations remain relatively low which should enable central banks to become less hawkish from later this year. Share market seasonality also improves into December and the direction setting US share market normally sees strong gains after mid-term elections.

Introduction

Investors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories. After the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets.

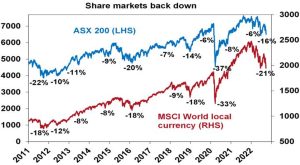

This year has been anything but. After falling sharply into mid-June (at which point US shares had fallen 24% from their highs, global shares 21% and Australian shares 16%), share markets rallied into mid-August reversing half of their declines on the back of hopes the Fed would pivot towards an easier monetary stance and hopefully avoid a recession.

Since mid-August though, shares have fallen again and are now back to around their June lows. Bond yields have pushed up again with US, UK, German 10-year yields rising to levels not seen in a decade.